Employee Resources

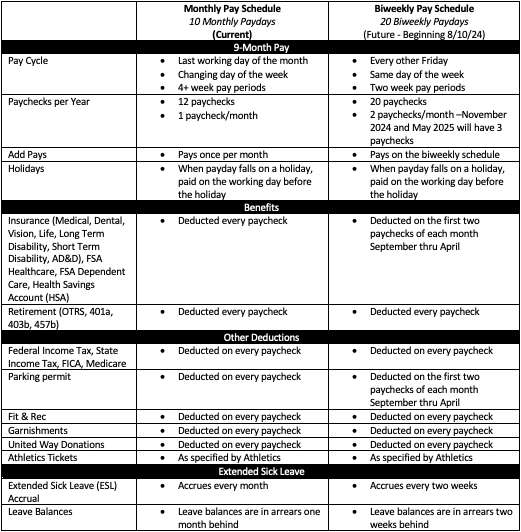

As the OU Norman campus works to transition all employees to a bi-weekly pay schedule, we want to provide our employees with resources we think may be helfpul. Below please find various tools that may help as you plan for this upcoming change in 2024.

Side-by-Side Comparison of Changes - 9/9 Faculty

Side-by-Side Comparison of Changes - 9/12 Faculty

Biweekly Pay Calculator for 9/9 Faculty

The below pay schedule demonstrates an example of gross payments for a 9 paid in 9 employee whose annual salary is $50,000 for the 2024-2025 academic year.

The Excel version of this calculator can be downloaded HERE and allows you to enter your specific net and/or gross salary.

Biweekly Pay Calculator for 9/12 Faculty - Contract renews on 8/1

The below pay schedule demonstrates an example of gross payments for a 9 month faculty member paid over 12 months with a contract renewal of 8/1 and whose annual salary is $50,000 for the 2023-2024 and 2024-2025 academic year.

The Excel version of this calculator can be downloaded HERE and allows you to enter your specific net and/or gross salary.

Biweekly Pay Calculator for 9-12 Faculty - Contract renews on 8/16

The below pay schedule demonstrates an example of gross payments for a 9 month faculty member paid over 12 months with a contract renewal of 8/16 and whose annual salary is $50,000 for the 2023-2024 and 2024-2025 academic year.

The Excel version of this calculator can be downloaded HERE and allows you to enter your specific net and/or gross salary.

Retirement Bi-Weekly vs. Monthly Frequency - 9/9 Faculty

Faculty paid on a bi-weekly schedule have retirement contributions made over all regular pay periods. This includes faculty and employer contributions such as OTRS, 403(b), 457(b), and *401(a) contributions.

Example: Faculty with a base salary of $50,000.

Retirement Bi-Weekly vs. Monthly Frequency - 9/12 Faculty

Faculty paid on a bi-weekly schedule have retirement contributions made 26 pay periods. This includes faculty and employer contributions such as OTRS, 403(b), 457(b), and *401(a) contributions.

Example: Faculty with a base salary of $50,000.

Benefits for Bi-Weekly vs. Monthly Frequency - 9/9 Faculty

Faculty paid on a bi-weekly schedule have health, life, and disability premiums collected over 16 pay periods. Below are examples of the faculty cost for monthly premiums versus bi-weekly premiums.

Benefits for Bi-Weekly vs. Monthly Frequency - 9/12 Faculty

Faculty paid on a bi-weekly schedule have health, life, and disability premiums collected over 24 pay periods. Below are examples of the faculty cost for monthly premiums versus bi-weekly premiums.

Explanation of Benefits Premiums in 2024-2025

During the 2024-2025 academic contract year all employees will receive the equivalent of one month's worth of medical insurance premiums. The paychecks in which the premium holiday is applied depends on the pay group the employee is in (i.e. 9 paid in 9 faculty, 9 paid in 12 faculty, 12-month staff, etc.).

Below you will find the paycheck schedule for each of the faculty groups that explains how their benefits premiums will be deducted on paychecks throughout the year.

For questions about your benefits please contact HRBenefits@ou.edu.

9/9 Faculty Benefits Premium Paycheck Calendar

9/12 Faculty with 8/1 Contract Renewal Benefits Premium Paycheck Calendar

9/12 Faculty with 8/16 Contract Renewal Benefits Premium Paycheck Calendar

Leave Accruals for Bi-Weekly vs. Monthly Pay Frequency - 9/9 Faculty

Full-time nine-month faculty with the rank of instructor or above will accrue 12 days of extended sick leave per year. Such faculty members working at least half-time (.50 FTE) but less than full-time (1.0 FTE) will receive leave accrual based on their FTE. There is no maximum on the accrual of extended sick leave.

Leave Accruals for Bi-Weekly vs. Monthly Pay Frequency - 9/12 Faculty

Full-time nine-month faculty with the rank of instructor or above will accrue 12 days of extended sick leave per year. Such faculty members working at least half-time (.50 FTE) but less than full-time (1.0 FTE) will receive leave accrual based on their FTE. There is no maximum on the accrual of extended sick leave.

IRS Withholding Calculator

To ensure proper federal income tax withholding, employees may use the IRS Withholding Calculator.

The ‘calculator’ helps you determine the recommended withholding allowance and additional withholding (if any) you should report on your W-4 form.

IMPORTANT NOTE: This Withholding Calculator works for most taxpayers. People with more complex tax situations should use the instructions in Publication 505, Tax Withholding and Estimated Tax.

Additional information on the IRS Withholding Calculator is available on the IRS website: IRS Withholdings Calculator

Magellan Financial Workshops

Attend a financial planning workshop hosted by Magellan Health! If you're looking for assistance in setting up or just restructuring your personal budget as you transition from a monthly pay schedule to biweekly, this workshop will offer you some tools and resources to do so. You must register in advance to attend the live webinar.

Opportunities to attend a workshop:

- View a Recording of the November 28, 2023 Workshop and download the Budget Workbook provided by Magellan Health.