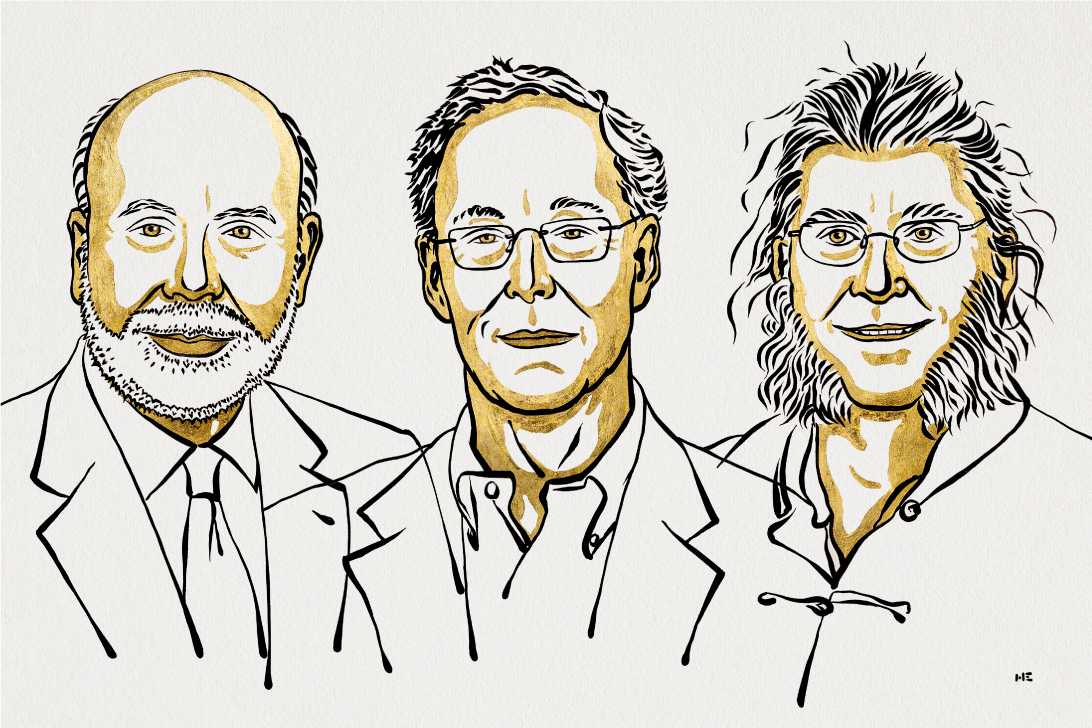

On Monday, October 10, 2022, Professor Philip Dybvig of Washington University in St. Louis, Professor Douglas Diamond of the University of Chicago, and Professor Ben Bernanke of Princeton University were awarded the 2022 Nobel Prize in Economic Sciences by the Swedish Academy of Sciences. This marks an important emphasis placed by the Nobel Prize committee on banking with the focus on the seminal work by Professors Dybvig and Diamond, published in 1983 in the Journal of Political Economy, titled “Bank Runs, Deposit Insurance, and Liquidity,” advancing our understanding of bank panics.

I first met Professor Dybvig 17 years ago, when he hired me as his junior colleague at the Olin Business School of Washington University in St. Louis. Being colleagues with him for a number of years, I have come to appreciate and seek his advice and I cannot think of a more deserving scholar to receive such recognition. I vividly recall, in October 2019, reaching out to him, expressing my hopes that he receives the Nobel Prize in Economic Sciences at the time. His humble answer was “thanks for the nice thought, but I doubt it (:” I am very glad that three years later, this is a now a fact.

The Diamond and Dybvig model has become the go-to model about liquidity and bank runs ever since it was published in 1983. As of the time of the writing of this op-ed piece, the article has been cited more than 13,000 times per Google scholar. The model has become so popular that often absent-minded academics will reference it colloquially without even citing it in their paper references – a practice every academic editor has been perennially working to correct.

At its core, the model shows that banks act as liquidity providers and that this makes them subject to possible bank runs (i.e. makes them more fragile). At the same time, bank fragility is an essential cost to be paid for the benefit of having bank liquidity provision to the entire economy, and importantly such benefit far outweighs the bank fragility cost. Their paper further goes on to provide positive prescriptions of how to address bank runs, in particular validating the important role played by deposit insurance in order to reduce the likelihood of a bank run on an otherwise perfectly healthy bank.

The model work of Professors Dybvig and Diamond was published at a time when no major bank runs were present in the United States. Yet, some 25 years later, in the great credit crisis of 2008-2009, the model has turned out to be an invaluable policy guidance tool that has afforded policymakers a prescription of how to act to swiftly address the negative consequences of bank runs or prevent them altogether. Interestingly, even today, at the time of writing this, some of the largest commercial banks in the world, like Credit Suisse, are experiencing similar circumstances as those captured in the Diamond and Dybvig model.

Here at the University of Oklahoma, I am aware of two papers that have done related work. To start, in a Review of Quantitative Finance and Accounting paper published in 1997 entitled, “Implications of Debt Renegotiations for Optimal Bank Policy and Firm Behavior,” retired Professor Scott Linn and co-authors explore the problems associated with renegotiation of debt contracts involving a bank and a firm managed by a risk-averse CEO. Their main finding is that renegotiation may be inefficient for the bank because of the likelihood of false bankruptcy claims and hidden action problems associated with exposure of the borrowing firm to the risk of default. In a more recent work, Professor Ehsan Azarmsa’s paper titled “Persuasion in Relationship Finance,” published in 2020 in the Journal of Financial Economics, analyzes the monitoring role of intermediaries which builds on the seminal work of Douglas Diamond and Philip Dybvig.