Below are frequently asked questions by OU students and their families. Visit our How-To Videos page for step-by-step instructions on common first year tasks. If you can't find your question below, Ask Your MoneyCoach!

Frequently Asked Questions

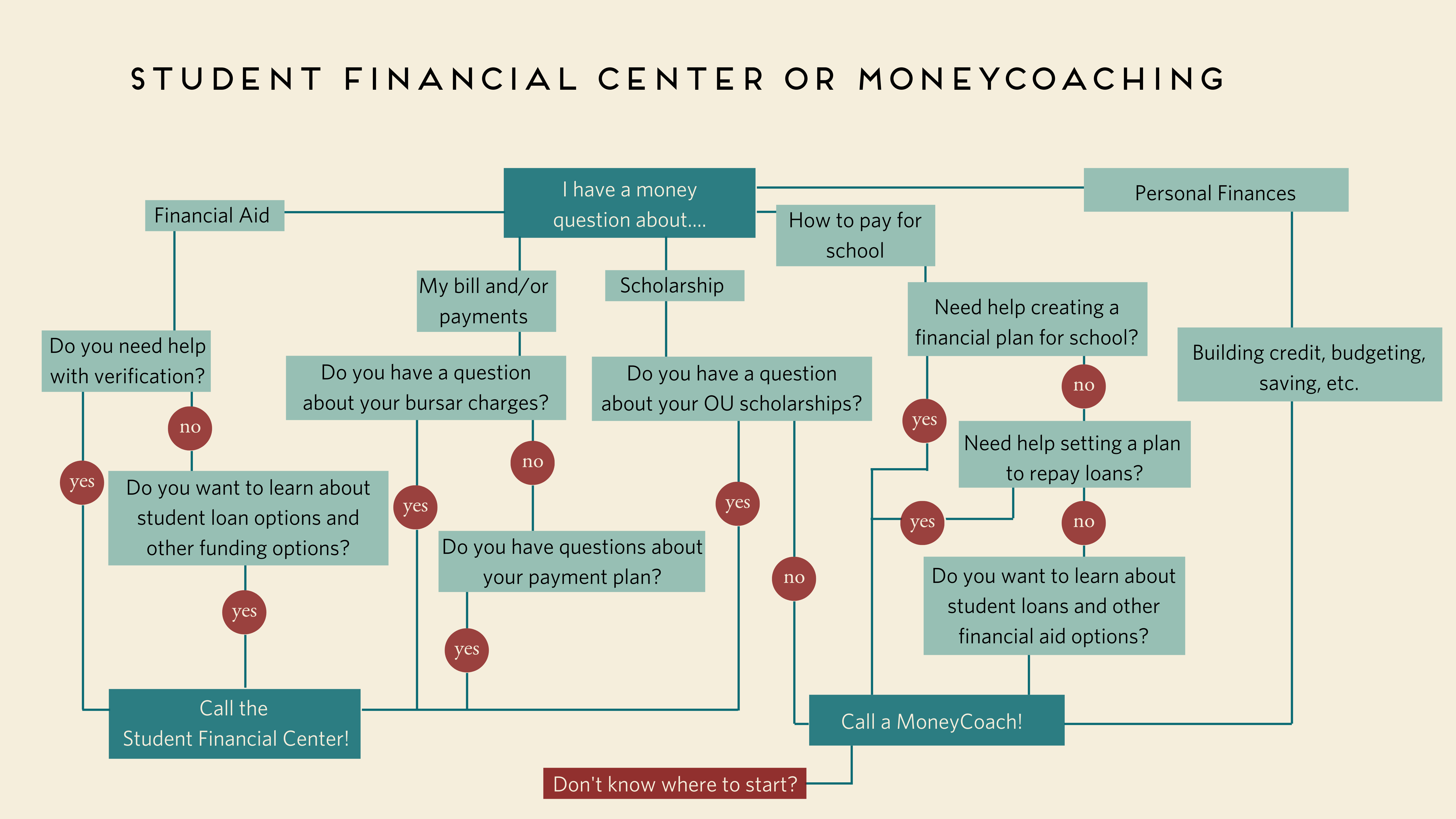

Who Should I Contact?

FAFSA

Below are common questions concerning the FAFSA. If you have questions about your specific FAFSA situation, contact the Student Financial Center at (405) 325-9000 or by email at sfc@ou.edu. You can also visit them in person at Buchanan Hall, room 106.

For technical issues with the FAFSA, contact their help line at 800-433-3243.

Yes, the MoneyCoaches encourage students to fill out the FAFSA, even if you don’t plan on taking out student loans. It is still a good back-up plan, in case something unexpected happens, as the most favorable student loans often require a FAFSA be on file. In addition, many scholarships prefer you have a FAFSA on file when considering your application.

The custodial parent should complete the FAFSA. The custodial parent for the FAFSA is the parent the student lived with the most during the 12 months preceding the date you complete the FAFSA. This is not necessarily the parent who has legal custody. If you evenly split time living with each parent, use the parent who provided the most financial support during the past 12 months.

If the parent you're living with is the custodial parent, and therefore providing their info on the FAFSA, then yes, the step-parent must report their info.

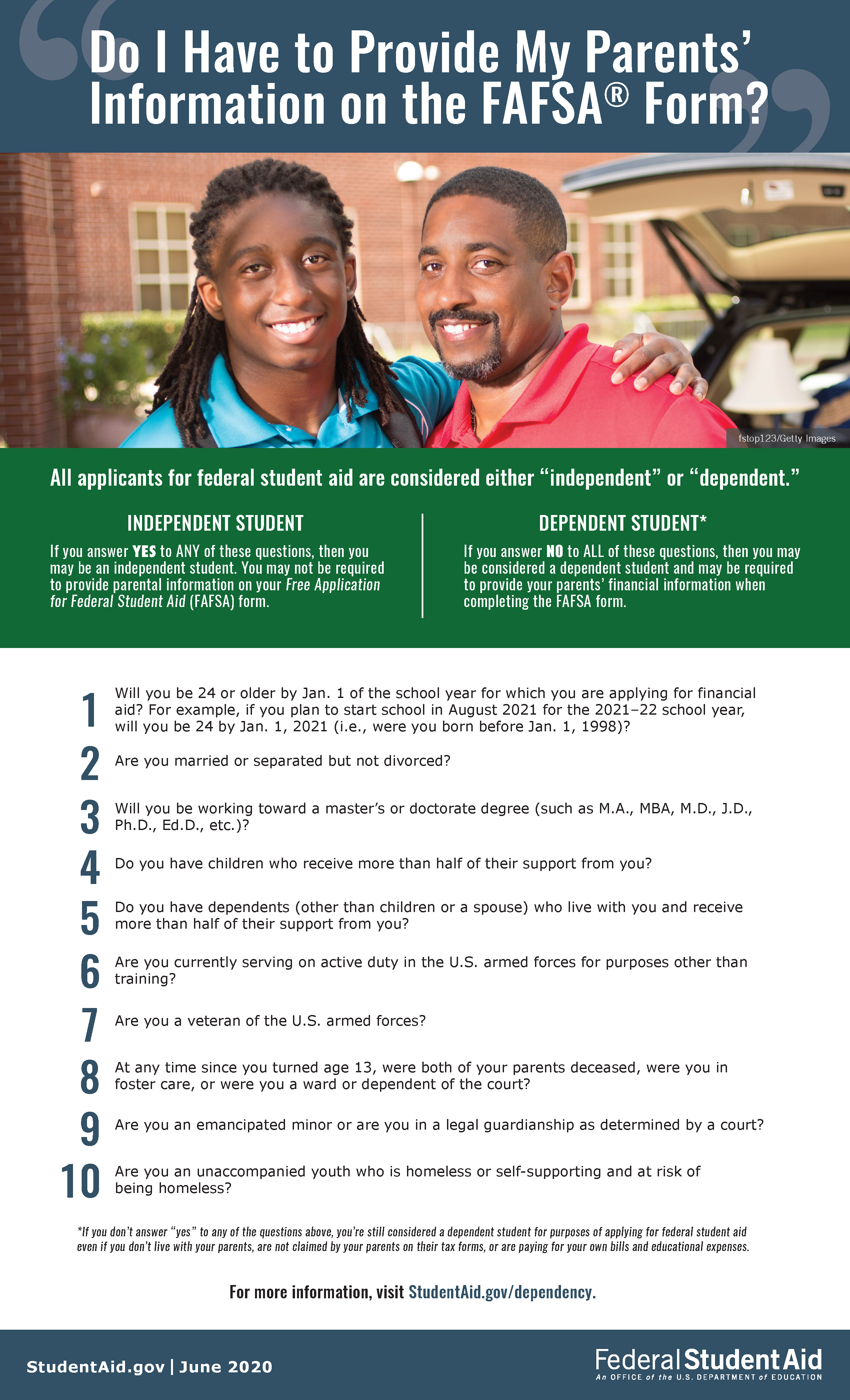

See attached official Dependency Criteria graphic from FAFSA. If you meet one of the ten criteria listed, you may eligible for Independent Status. Still not sure? Ask your MoneyCoach!

First Year or Transfer Students

Below are common first year and transfer questions about OU. If your question is not addressed below, ask your MoneyCoach! You can email us, schedule a meeting, or call at (405) 325- 4692.

In most cases, if you are classified as an out-of-state student upon your entry to OU, the answer is no. However, there are some extenuating circumstances in which an out-of-state student might be reclassified as in-state. For details about how residency status is determined, frequently asked questions regarding residency and to access the In-State Residency Petition, click here.

No, students are charged per semester, as fees are based upon the courses each student is enrolled in for the term in question.

A bursar registration hold means that you are not able to enroll in courses, because your account is currently not up-to-date with the OU Payment Plan. Please schedule an appointment with your MoneyCoach to discuss your specific plan and ways to pay off your balance.

Due to the Family Educational Rights and Privacy Act (FERPA), OU staff are not able to share details about a student’s account or financial plan unless they have explicit, written permission from the OU student that states the individuals name and a clear statement about what information the staff member may share with the identified person. If the student is granting a MoneyCoach permission via email, the email will need to come from the student’s OU email account.

Once a student’s Bursar bill is completely paid and the balance is $0, any additional aid that is applied to the account throughout the semester will be issued back to the student in the form of a refund. The refund will either be electronic, if the student set up an account in one.ou.edu or a check.

An appeals process has been established for students with special circumstances who are unable to enroll in 15 credit hours. The appeal form must be completed by the student and returned with documentation to the Office of the Bursar for review. These circumstances may include:

- Students with disabilities.

- Students with fewer than 15 hours remaining per semester until graduation.

- Students participating in a study abroad program.

- Students with temporary medical condition.

- Students who are under contractual agreements (academic and/or scholarship) with the university that limit enrollments to less than 15 credit hours.

- Students in official University sponsored activities to which he/she commits 25 or more hours per week for a substantial portion of the term.

- Students limited fewer than 15 credit hours due to their curricular structure.

- Students participating in an internship.

- Students with unforeseen circumstances that directly affect them.

A Flat Rate Appeals Committee has been established to review all Flat Rate Tuition Appeals. The committee consists of student representatives, Bursar and Financial Aid staff members, and Academic counselors. The committee reviews all appeals and documentation, and will notify students of their decision via email to their OU email account. The committee may request additional information from students as needed.

The committee requires documentation for all appeals. Types of acceptable documentation include, but are not limited to:

- Advisor Recommendation Form - available through a student's college level advisor

- Letter from Disability Resource Center

- Proof of study abroad plans/commitment

- Doctor's Note

- Copy of academic or scholarship contract which limits enrollment

- Letter from sponsor of a University activity

Undergraduate students will be charged the undergraduate rate for all the courses they take, regardless of the level of the courses. As undergrads, students will be subject to flat rate if they are enrolled in 12 hours or more.

No. Your banked hours cover tuition (resident and non-resident) and hourly-mandatory fees only. The college program and technology fees, academic excellence fee, semester fee, and any other applicable course-charges are not included in banked hours.

Federal regulations require that students make Satisfactory Academic Progress (SAP) toward their degree at the University of Oklahoma to be eligible for financial aid. SAP is evaluated at the end of each semester.

Students who fail to maintain minimum GPA and/or course completion standards will lose their eligibility for federal, state and campus-based aid administered by Financial Aid Services.

Students are notified of their failing SAP status by mail.

Students may also view their current SAP status in One.

Submit a Satisfactory Academic Progress Appeal form explaining any extenuating circumstances and/or personal issues that contributed to your SAP failure and include any supporting third-party documentation.

You may complete, sign and submit your SAP Appeal form online.

Visit ou.verifymyfafsa.com to create or logon to your account.