PeopleSoft Codes & Payment Types

Listed below is information covering PeopleSoft payroll codes, Leave action summaries, and instrutions for individual compensations scenarios. For further detailed information regarding Norman PeopleSoft Payroll and ePAF transactions, please view the Guide to Payroll & Records PDF listed below.

PeopleSoft Payroll Codes & Pay Classifications

GT Batch Form Processing allows users to use a CSV file to create forms for each line in the file utilizing a single batch upload. Listed below is the form and instructions used to enter batch add pay data to load into peoplesoft add pay epaf system.

Hourly Employees

Use the paper supplemental pay form for hourly employees or terminated employees unless otherwise instructed by Payroll & Employee Services to adjust ePAFs that have already been in process in PeopleSoft HCM. The form must be completed and approved by the appropriate approvers before the supplemental pay is entered into the PeopleSoft time entry system. Internal Auditing audits this information.

The department is responsible for entering a supplemental pay request for the current pay period. The form should be retained in the department's files.

Payroll & Employee Services must enter supplemental payments for previous pay periods and flat rate payments to hourly employees. Questions about whether or not an employee can be paid a flat rate supplemental should be directed to HR Employment & Compensation and/or the Provost Office.

Salaried Employees

Supplemental payments for active salaried employees should be submitted through the ePAF Addidtional Pay. Once the ePAF has been submitted, DO NOT enter the supplemental payment through time entry. Doing so will result in an overpayment to the employee.

NOTE: The individual who prepares the supplemental payment form cannot sign as an approver at any level on the form.

Terminated Employees

Terminated employees that need to be paid a one-time supplemental must complete and submit an I-9 (with supporting documents) and Loyalty Oath to Payroll with the supplemental form. The paying department will need to submit a rehire ePAF effective the first day the work was done as noted on the supplemental pay form. Your department will still be out of compliance with federal hiring regulations if the I-9 is not completed and E-verified within 3 business days from the date on the rehire ePAF.

Income Assignments are checks that can be requested if an employee misses a payroll for reasons such as late PAF, late paper work, or late time sheets. There is a $100.00 processing fee per check that is issued for a processing error made by the sponsoring department or employee. Income Assignment checks take 5-7 business days to process and can take longer during peak times or if paper work is not received.

Income Assignments can be requested once appropriate paper work such as PAF, employee paper work, and/or time sheets are received by Payroll and Employee Services.

Note: The department representative cannot sign as the Account Sponsor or Dean/Director. The Account Sponsor and Dean/Director must be 2 different names/signatures.

The process for income assignments:

- Complete the Emergency Check Request Form. It can be found on the HR website under Documents and Forms. The form needs to be completed by the department and submitted to the Payroll and Employee Services.

- Once the paper work is processed in PeopleSoft, Payroll will request an estimated check for the missed payroll by submitting appropriate forms to Financial Support Services. A $25 amount will be debited from the net amount for employees that are not benefits eligible. The employee will receive that amount back on their next paycheck. This is withheld to ensure that there are funds available to withhold the income assignment.

- The net income assignment is debited from the Payroll income assignment account not the department account.

- All paper payroll checks will be mailed to the address of record as listed on Employee Self-Service.

- On the next payroll date, the gross wages will be charged to the departments account. Expect to see the gross amount on your extract at that time.

- The Income Assignment amount (net) will be deducted from the employee’s paycheck and credited back to Payroll’s income assignment account. The department will not be able to see that transaction, but the employee will see the deduction on their check.

We prefer not to process income assignments if the employee can wait until the next payroll. Before requesting an Income Assignment, please verify that the employee needs the money before the next payroll.

Emergency checks are made available to assist employees who did not receive a pay check and are unable to wait for the next scheduled pay date for payment. Emergency checks cannot be issued for additional earnings such as supplemental pay, retroactive payments, bonus pay, or stipends.

The departmental representative should complete the Emergency Check Request Form. No payment will be issued without the signature of the employee to be paid and an authorized departmental representative. Return the completed form to Payroll and Employee Services, 905 Asp Ave, NEL 244, Norman, OK 73069.

If the employee receives direct deposit of their payroll check, the emergency check could be directly deposited into the same bank account. It generally takes seven (7) business days to process payment once the form and backup documentation has been received. Contact Payroll and Employee Services with questions.

Payroll extracts are created during processing each pay period to provide departments reports to compare compensation data for their employees during and after the payroll process.

Extracts are typically initially available on Wednesdays during payroll processing (subject to change based on Holiday closure) after the first extract email is sent out. All departments will have approximately 24 hours to review and communicate with Payroll regarding issues. Departmental representatives reviewing extracts can forward any questions to payroll@ou.edu to inquire about discrepancies found on the reports.

Payroll extracts will be 'rebuilt' periodically during the processing of payroll to reflect updates made during reconciliation and departments will be notified via email when this occurs.

For additional information on 'How To' run extracts please reference the PDF guide below.

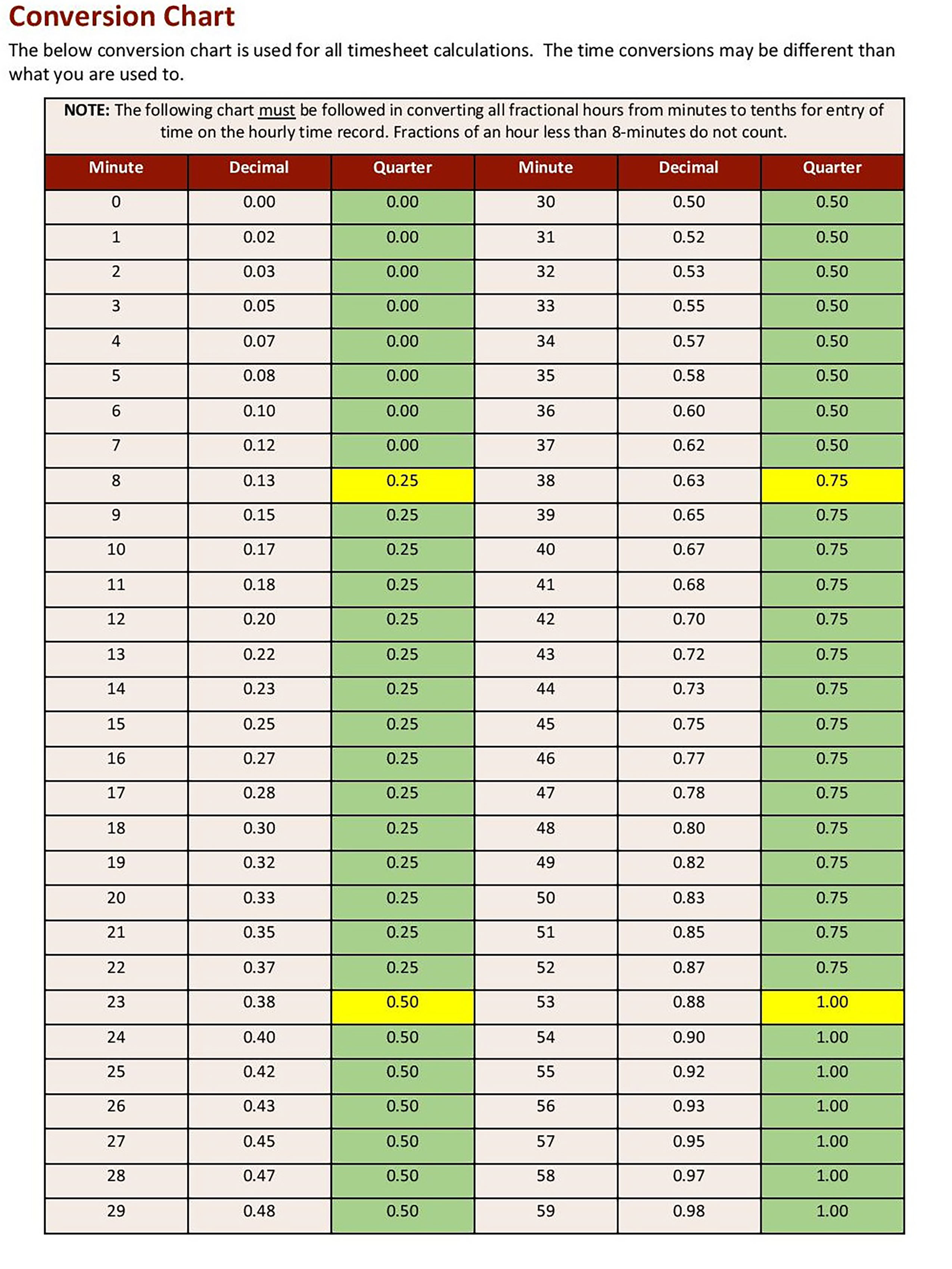

For reporting minutes worked that are less than an hour, round minutes to the nearest tenth of an hour. The following chart is to be used when converting all fractional hours from minutes to tenths for entry of time on the hourly time record. Fractions of an hour less than eight minutes are not recorded.

Overpays can occur for many reasons. When an employee is overpaid, the department will be responsible for making arrangements with the employee to collect the amount of overpay. Payroll will calculate the net or gross amount to be repaid and notify the department.

If the employee is still employed, the overpayment must be withheld from the employee’s future paychecks not to exceed 3 pay period deductions. It can only be withheld in the same calendar year that the overpayment occurred. For an overpay that occurs in November, Payroll must withhold the full amount on the December paycheck.

Overpays must be corrected in the current year so that the employees W-2 will be correct.

Payroll will e-mail an Overpayment Agreement form to the department. The employee needs to read, designate the amount withheld per pay period, sign, date, and return the form to Payroll and Employee Services.

If the employee is terminated, the employee must write one check to the University of Oklahoma for the full amount. The employee will be responsible for repaying the net amount during the same calendar year the overpayment occurred. The deadline for repaying the net overpay is November 30th. The employee will be repaying the full gross amount if paid after November 30th or in a future calendar year.

Payroll Expense Transfers are only used to correct past payroll actions such as an employee’s salary being paid from an incorrect account number and/or object code. Earnings Distribution Request forms should be submitted to correct future payroll actions.

If the amount is split between accounts, only list the amount that was paid incorrectly. For example, the employee’s salary is paid 50% from one account and 50% from another account and only the 50% of the salary was paid from the wrong account. The payroll expense transfer should only list the 50% that was paid incorrectly.

Payroll Expense Transfers will not show up on the extracts. They will show up on the Statement of Accounts (Commitment vs. Budget).

Contract pay options are 9 paid in 10 months (9/9) or paid in 12 months (9/12) faculty. See Faculty Payment Option below.

Contract pay is NOT paid to Graduate students or staff members.

Monthly amounts for 9/9 employees can be calculated using the Contract Pay Spreadsheet sent out by Payroll and Employee Services. If you do not have a copy, contact your payroll representative and they can e-mail it to you. Faculty are paid a partial month in August and May which is based on working days.

Monthly amounts for 9/12 employees can be calculated by dividing the annual amount by 12. The employee will be paid the same monthly amount for August through July. Newly hired 9/12 employees will be paid a partial amount in August with the remainder of the contract paid over the next 11 months.

The department must extend the contract for non-budgeted or pool positions every semester (4.5 months) or year (9 months). This can be done by completing an ePAF using DTA/CEX. Start a new ePAF/Edit Existing Job – enter the Empl ID then enter the effective date the contract extension will begin. Finally, check the box that asks if you want to extend the contract.

When transferring an employee in a faculty title from one pay group to another (such as 9/9 to monthly), put in the remarks that the employee is “moving from 9/9 to monthly appointment” (or other pay group). In ePAF, choose the appropriate new contract months under the FTE and compensation information.

Faculty Payment Options

Faculty members appointed for nine months have the option of receiving their salary in 10 payments or 12 payments. Faculty members must complete a Faculty Payment Option Form located on the HR website under Documents and Forms. Changes must be made before August 5th of the following contract year. Changes can not be made after August 5th due to IRS regulations.

Calculating Contract Pay Changes

The first step taken when calculating a contract pay change (increase or decrease) is to determine a blended rate based on a 9/9 contract. If the employee is being paid 9/12 you still need to determine the blended rate based on a 9/9 contract.

To calculate the blended rate, determine the total amount the employee should be paid prior to the pay rate change and the total amount the employee should be paid after the pay rate change. Add the two totals together to get the blended rate. See Appendix A.

The final step is to determine the remaining payments for the contract. This step is not the same for a 9/9 and 9/12 contracts.

For additional information and calculation examples for contract 9/9 or 9/12 pay increases, please visit the Payroll Guide (PDF) listed below.

In almost every circumstance, gifts, prizes and awards given to university employees are reportable as income and are included in the recipient's taxable wage if the gift is paid for by the university. If the gift, prize, or award is cash, it should be processed as a paper supplemental payment (see above tab) and must be paid through the payroll system with appropriate taxes withheld. If the payment is for an award, be sure to clearly state the payment is for an AWARD in the comments section of the supplemental pay form. Non-cash gifts, prizes, or awards should be reported to payroll by the department initiating the gift, prize, or award. The fair market value of the item is taxable and will be reported on the recipients W-2.

The department may choose to pay the employee's share of taxes on a gift, prize, or award; however, the taxes paid by the employer are taxable wages to the employee.

Please contact Payroll and Employee Services if you have any questions regarding the payment of gifts, awards, and prizes.

Any nine-month faculty being paid with summer money (whether they are paid 9/9 or 9/12) will require an Additional Pay ePAF. Distribution for the summer pay should be shown on the ePAF. Please do not send an Earnings Distribution Request (EDR) for such distributions to the Budget Office.

Monthly faculty salaries may be no more than one-ninth of the 9-month contract salary in a given month. The following is an example of how to calculate the amount of summer money a faculty can receive in May, June, July or August.

Calculating Salary for May and August

Annual Rate of Pay divided by 9, divide by 2

($40,000 / 9 = 4,444.44 / 2 = 2,222.22 for May and August)

Calculating Salary for June and July

Annual Rate of Pay divided by 9

($40,000 / 9 = 4,444.44 for June and July)

Use the Budgeted Rate

Please use the budgeted rate for calculating summer money and not the annual rate of pay on JOB; the annual rate amount could reflect a blended rate depending on salary changes during the year. The budgeted rate is located in PeopleSoft on the JOB page under the 'compensation' tab. Colleges are given the discretion of allowing July and half of August to be paid to faculty receiving ranked promotion increases at their new rate. These increases will not be updated on the budgeted rate until August 16th.

Salaried Employees

Pay rate changes for salaried employees can be effective on any day of the month. The PAF to change the rate of pay must be submitted to Payroll and Employee Services before the current monthly PAF deadline. If the PAF is received after the monthly deadline, any necessary retro payments will be calculated by Payroll and Employee Services and added to the next monthly payroll.

If the pay rate change is to reduce an employee’s monthly pay and the PAF has not been approved by Payroll and Employee Services before the current monthly deadline, please contact Payroll and Employee Services and advise your department's HR payroll technician as soon as possible.

Hourly Employees

Pay rate changes for hourly employees must begin on the first day of a pay period. The PAF to change the rate of pay must be received by Payroll and Employee Services before the current hourly PAF deadline. If the rate change must begin on a day other than the first day of the pay period, the rate change will not be processed until the beginning of the next biweekly payroll. The department will need to submit a Supplemental Pay/Payroll Correction form to pay the employee for the difference in the rates of pay for the hours worked. This amount will be paid on the current biweekly payroll in which we receive the completed Supplemental Pay/Payroll Correction form as long as the PAF to change the rate of pay has been received and processed by Payroll.

All pay rate change PAF's must have proper signatures before Payroll and Employee Services will process them.

Use this form for Employee Expense Reimbursements that have exceeded the 120 days to individuals who are appointed to the Norman campus and are currently being paid through the University payroll. Please send completed form with the appropriate signatures and copies of the receipts to the Payroll office at payroll@ou.edu.

Additional Pay Classifications (Leave)

For additional information and policies for reporting and calculation Time and Leave, please visit the Holidays, Time Off, & Leave page.

PeopleSoft Earnings Codes: Paid Leave

- PLS - Paid leave scheduled non-exempt

- PLU - Paid leave unscheduled non-exempt

- SPL - Paid leave exempt

- PFM - Paid leave/FMLA non-exempt (when FMLA-qualifying event is included)

- FML - Paid leave/FMLA exempt (when FMLA-qualifying event is included)

Policy Summary

Definition: Accrued hours that may be used by twelve-month faculty and staff, with supervisory approval, for paid time off.

Summary of Policy: To accrue paid leave employees must hold a continuous appointment of at least 50% Full Time Equivalent (FTE).

FTE is based on the total of all hours in an employee’s active job record(s). 1.00 FTE = 173.33 standard hours each month.

Leave accrual rates are based on employment category and/or years of service. Accrual maximums are the same for all employees of an employment category regardless of FTE.

Medical residents, 9-month faculty, temporary and student employees do not accrue paid leave. See details under "Accrual Rates & Guidelines by Employee Group."

When does Paid Leave accrue?

Paid Leave will accrue for the amount of time or percentage of time a benefits eligible employee is on:

- Paid leave

- Paid leave-FMLA

- Sabbatical (full or half-pay)

- Paid administrative leave

- Paid military leave

- Judicial leave (jury duty)

- Holiday pay

- Paid class hours

- Compensatory time taken

When does Paid Leave "not" accrue?

Paid Leave will not accrue for the amount of time or percentage of time an employee is on:

- Leave without pay

- Extended sick leave

- Military leave without pay

- VA or non-university funding

- Leave without pay-FMLA

- Administrative leave without pay

- Terminal paid leave

For monthly paid employees using one of the leave types above, the paid leave accrual will be prorated based on the number of days worked in proportion to the employee’s FTE.

Biweekly paid employees will receive paid leave accrual on the hours submitted as hours worked or for the leave types listed above under ‘When does leave accrue?’.

PeopleSoft Earnings Codes: Overtime & Comp Time

- CPA - Comp time Earned

- CPT - Comp time taken

- CPP - Comp time pay out

Policiy Summary: Overtime

Overtime is compensation for hourly employees (non-exempt employees) that are required to work in excess of 40 hours in a designated work week. Part-time hourly employees (less than 1.0 FTE) do not accrue overtime unless they work more than 40 hours in a designated work week.

Overtime work must be approved in advance by the supervisor.

Hourly employees accepting work in a budget unit other than their primary one are responsible for notifying the secondary budget unit of their employment status with the university. Whenever the combined hours of work of hourly employees exceed 40 hours in a work week, overtime pay must be paid for the excess hours. In each such instance, the budget unit exceeding the appointed FTE will be responsible for paying overtime.

Pay Rate:

Hourly employees are eligible for overtime pay at the rate of time-and-a-half for the time worked in excess of 40 hours per work week. For the purposes of computing overtime pay, paid leave and holidays will be treated as hours worked in Norman programs only. Paid leave and holidays are not to be used to calculate overtime pay for HSC programs.

Exclusions:

Excluded from overtime compensation are unscheduled paid leave, extended sick leave, administrative leave, and services that are occasional and sporadic in nature, performed solely at the employee’s discretion, and that are unrelated to the type of work normally performed by the employee (e.g. taking tickets, ushering, parking cars, keeping athletic scores, etc.).

Salaried employees (exempt employees) are not normally eligible for overtime pay. Exceptions to this policy must be approved in advance by the appropriate provost or vice president.

Policy Summary: Compensatory Time

Compensatory Time:

Compensatory time (comp time) is an alternative method for compensating hourly (non-exempt) employees who work overtime. No overtime is to be worked unless it is approved in advance by the employee's supervisor.

No employee shall be required to receive compensatory time off in lieu of overtime pay unless an agreement or understanding is reached by the employer and employee before the performance of the work.

Accrual Rate:

Compensatory time is accrued as one-and-one-half hours for each hour worked in excess of 40 hours in a work week. Compensatory time can be used by the employee like paid time off.

Limitations:

Compensatory time off must be taken within one year of the date of accumulation. Employees will be automatically paid for compensatory time not taken after one year.

No more than 90 hours of compensatory time (60 hours worked) may be accumulated. Employees will be paid automatically for any compensatory hours in excess of 90.

Transferring or terminating employees will be required to use all compensatory hours before transferring or be paid by the department in which the compensatory time was accrued.

Exclusions:

Salaried (exempt) employees are not normally eligible for compensatory time. Exceptions to this policy must be approved in advance by the appropriate provost or vice president.

Designated Work Week

The normal, designated work week shall begin at 12:01 am Saturday and end the following Friday at midnight.

Departments working flexible or alternative schedules may change the standard work week with approval from Human Resources.

PeopleSoft Earnings Code: Holidays

- HOL - Holiday

Policy Summary: Holidays

Definition: Designated days when university offices are closed and employees receive pay. To be eligible for holiday pay, employees must hold a continuous appointment of at least .50 FTE.

Summary of Policy: Holiday time is granted to benefits eligible employees in proportion to their full-time equivalency (FTE). Faculty appointed to 9-month positions* will be granted holiday time for those holidays which fall within their contract. Students and other temporary employees are not eligible for paid holidays.

The University recognizes 11 paid holidays each academic year. Human Resources publishes the Holiday schedule. The Tulsa Campus may operate under varied policies and may publish a separate schedule. Holidays on Saturdays will be observed by the university on the preceding Friday. Holidays on Sundays will be observed by the university on the following Monday.

*HSC programs may also rarely have faculty appointed to 10-month positions. In those cases, policies for 9-month faculty also apply to 10-month faculty.

Receiving Pay for the Holidays

To receive compensation for holidays, an employee must be at work or on approved leave with pay on the day preceding or the day following the designated holiday.

Terminating employees must work either the day preceding or the day following a holiday to be eligible for holiday pay. Contact Human Resources for information.

Retiring employees, i.e. employees receiving OTRS, OU, or Social Security retirement, and the beneficiaries of deceased employees will be paid for accrued paid leave time up to the maximum accrual allowance and will receive pay for holidays falling within the terminal pay period.

Prorated Holiday Pay by FTE

Holiday compensation is prorated based on full-time equivalency (FTE) for benefit eligible employees with less than 1.0 FTE.

Example 1: Prorating for an employee with one position and an FTE of .50 for the month of November (16 holiday hours).

Calculation: 16 x .5 = 8 hours of holiday pay

Example 2: Prorating for an employee with multiple positions and an FTE of .60 – eligible for benefits at 60% - for the month of November (16 Holiday hours).

Calculation:

(Position 1 .30 FTE) 16 x .30 = 4.8 hours holiday pay

(Position 2 .30 FTE) 16 x .30 = 4.8 hours holiday pay

TOTAL = 9.6 hours holiday pay

Alternative Dates to Official Holidays

University offices are officially closed on these holidays except where continuous operations must be sustained to avoid conflicts with patient care, teaching schedules, and service-related functions.

Benefits eligible employees who are required to work on these specific dates may be given an alternative date(s) to take the designated holiday. The alternative holiday is to be scheduled between the affected employee and their supervisor.

PeopleSoft Earnings Codes: Extended Sick Leave

ESL - Extended sick leave for non-exempt employees

XSL - Extended sick leave for exempt employees

Policy Summary

Employees must hold a continuous appointment of at least .50 FTE to accrue extended sick leave (ESL). ESL may be used only after hours have accrued. ESL is available to be used for personal illness of the employee. How quickly ESL can be used depends on the kind of appointment the employee has (see following panes).

Acceptable medical documentation of illness or disability and supervisory authorization are required before charges to ESL are allowed.

Using ESL: 12-Month Employees

For employees that are in 12-month appointments, extended sick leave for personal illness shall be taken in the following order:

Five (5) days of paid leave time

Extended sick leave

Compensatory leave

Remaining paid leave time

Leave without pay

Using ESL: 9-Month Employees

Faculty appointed to 9-month positions* accrue 96 hours (12 days) of extended sick leave per year. There is no maximum accrual amount for full-time faculty members with the rank of instructor or above who hold continuous appointments. 9-month faculty do not accrue other paid leave.

Nine-month faculty may use extended sick leave once hours have been accrued, with approval from their supervisor. If no hours have been accrued, time will be charged to leave without pay.

Absences of 9-month faculty for reasons other than personal illness will be charged as leave without pay.

Norman Faculty Handbook: Extended Sick Leave Policy for Nine-Month Faculty, Section 3.21.4

Transferring Paid Leave to ESL

An employee may transfer accrued paid leave time to an ESL account by submitting a written request to their supervisor or payroll coordinator. Time deposited in the extended sick leave account may not be transferred back to the employee’s paid leave account.

PeopleSoft Earnings Code: Terminal Paid Leave

- TPL - Terminal Paid Leave

Terminal leave is when the university pays an employee the value of their accrued paid leave balance when they terminate. The policy depends on the kind of appointment the employee has. No payment is made for extended sick leave balances. Payment for terminal leave will not include university holidays that fall within the terminal leave payout period except for retiring employees (see below).

Note: Terminal Paid Leave for monthly employees will be paid the monthly payroll following (after) the employees final regular payroll cycle.

12 Month Employees

12-month employees who terminate employment and who have been employed by the university in a benefits eligible position will be paid for accrued paid time off, not to exceed the employee’s annual accrual amount.

Grants & Contracts

12-month employees who terminate employment and who have been employed by the university in a benefits eligible position will be paid for accrued paid time off, not to exceed the employee’s annual accrual amount.

Retiring Employees

Retiring employees, i.e. employees receiving OTRS, OU, or Social Security retirement, and the beneficiaries of deceased employees will be paid for accrued paid leave time up to the maximum accrual allowance and will receive pay for holidays falling within the terminal pay period.

9-Month Employees

When an employee terminates, they are not paid for extended sick leave balances. Faculty appointed to 9-month positions* only accrue extended sick leave so they will not be paid any leave balances upon termination.

PeopleSoft Earnings Codes: Administrative Leave

- Norman: ADM - Administrative leave for non-exempt employees

- Norman: ADL - Administrative leave for exempt employees

Administrative Leave

Administrative leave with pay may be granted when it is determined to be in the university’s best interest that an employee not return to work for a specified period of time or for designated emergency closings of the university because of inclement weather, natural disaster, pandemic illness, or other events as determined by the President. Authority to grant administrative leave requires prior approval by the President, appropriate provost, or vice president.

Time approved for administrative leave will not be charged to an employee's paid time off account.

Note: To be eligible for administrative leave an employee must be scheduled to work on the day leave is administered. If an employee is not scheduled to work or has used "leave" for the day that administrative leave occurs the employee will not be eligible for administrative leave for that day.

Eligibility

Benefits-eligible employees, except those assigned to certain federal grants and contracts, are eligible to receive administrative leave with pay.

Employees who are not benefits eligible are paid only for time worked and are not eligible for administrative leave.

Part-time employees receive administrative leave only for the hours they were scheduled to work on the day(s) that administrative leave was authorized.

PeopleSoft Earnings Codes: Judicial/Jury Leave

- Norman: JRY - Jury duty for non-exempt employees

- Norman: JUR - Jury duty for exempt employees

Judicial/Jury Leave

Pay will be given to benefits eligible employees who are 1) called for jury duty or 2) subpoenaed as a witness before a court of law, legislative committee, or judicial body.

Documentation is required to access time off for judicial (jury) leave and should be maintained in the department file.

PeopleSoft Earnings Codes: Military Leave

- MIL - First 30 days of military leave for non-exempt employee

- MLT - First 30 days of military leave for exempt employee

Requests for military differential pay should be submitted to HR

The department processes an ePAF placing the employee on paid military leave (PLA/MIL) for the first 30 days. Once the 30 days have elapsed, the department will process an ePAF placing the employee on military leave without pay (LOA/MIL). When the employee returns from military leave, the department will process an ePAF returning them from leave (RFL/RFL) to place the employee back in pay status.

Military Leave

Employees who are members of the Oklahoma National Guard or any branch of the United States military or its reserve components are entitled to a leave of absence with pay for the first 30 regularly scheduled work days of active military duty during any federal fiscal year (October 1 through September 30) when ordered by proper authority to active or inactive duty. The leave with pay will not be charged against paid leave or other accrued benefits.

Employees who are employed by the university for brief, nonrecurring employment that is not expected to last indefinitely or for a significant period of time are not entitled to military leave except under limited conditions. Contact Human Resources for assistance regarding such determinations.

The employee must provide their department a copy of written military orders before time off can be granted.

Pay & Pay Differential

The following guidelines are applicable for military leaves on or after September 11, 2001, and during the period that “Operation Enduring Freedom” is in effect:

During the first 30 regularly scheduled work days, employees will receive their full regular pay.

For leave that extends beyond 30 regularly scheduled work days, the university will pay the difference between the employee’s full regular pay and their military pay, if any.

Employees should schedule an appointment with Payroll & Employee Services to discuss differential pay.

Review these links for more information:

PeopleSoft Earnings Codes: Disciplinary Leave

- Norman: ADM - Administrative leave for non-exempt employees

- Norman: ADL - Administrative leave for exempt employees

Disciplinary Leave

An employee may be placed on a leave of absence with or without pay when it is in the best interest of the university to do so. Contact HR Employee Relations or the HR Business Partners with questions concerning disciplinary leave.

- With pay for 1 working day

- Without pay for up to 5 working days

PeopleSoft Earnings Codes: Family & Medical Leave Act

- FML – FMLA with pay non-exempt

- FMN – FMLA without pay non-exempt

- PFM – FMLA with pay exempt

- UFM – FMLA without pay exempt

Family & Medical Leave Act (FMLA)

FMLA leave runs concurrently with other types of leave. Employees are required to use accrued paid leave and extended sick leave (for their own serious health conditions) while taking FMLA leave before taking any unpaid leave of absence. Absences related to an on-the-job injury for which Workers’ Compensation is received will also be designated as FMLA if the employee and/or the event is eligible.

See the Staff Handbook, Section 3.10 and Section 3.11, regarding paid leave and other types of leaves of absence.

PeopleSoft Earnings Code: FMLA

- FMN - FMLA without pay (if LWOP includes a FMLA qualifying event)

Leave Without Pay

Leaves of absence without pay may be reported for an employee when no paid leave time is available. Leaves of absence without pay (LWOP) for personal reasons may be recommended by the Budget Unit Head or Medical Program Director (for Medical Residents) when it appears to be in the best interests of the university and the employee. Such leaves may not exceed one year in length.

Leave without pay for FLSA-exempt (salaried) employees may not be for absences of less than one day's duration.

LWOP does not count as service time worked for computation of benefits other than retirement or FMLA as specified.

PeopleSoft Earnings Code: Workers Compensation

- OJI - On-the-job injury for exempt and non-exempt employees

Workers' Compensation

When employees are off work as part of a workers' compensation claim, use the code listed above to track their time away from work.

PeopleSoft Earnings Code: Sabbatical

Contact the Provost's office for assistance recording sabbatical time.

Sabbatical leave may be granted to regular faculty for specialized scholarly activity or broad cultural experience. Contact the Provost's office for more information.

Eligibility

The university allows employees to donate paid leave to eligible employees through the shared leave program. The employee receiving leave must meet the following eligibility requirements:

- 12-month faculty or staff

- benefits-eligible appointment

- continuous employment with the university for at least 12 months

- used all paid leave, including but not limited to accrued paid leave, extended sick leave, and compensatory time

- experiencing a life-threatening or catastrophic health condition which has caused, or is likely to cause, the employee to take leave without pay.

Requests to receive or to donate leave must be submitted on the required forms below to the campus Shared Leave Committee. The Committee approves the distribution of shared leave.

Guidelines

- Shared leave is meant to cover only the duration of the life-threatening or catastrophic health condition for which it was approved.

- Donated paid leave is transferable between employees within each campus with the approval of the Shared Leave Committee.

- No employee shall be coerced, threatened, intimidated, or financially induced into donating paid leave.

- Employees receiving shared leave will not accrue paid leave.

Frequently Asked Questions

- Who is eligible to be a recipient in the Shared Leave Program?

The employee must be a twelve (12) month faculty or staff employee in a benefits-eligible appointment that accrues paid leave and who has held continuous employment for at least twelve (12) months.

- What is the definition of a serious health condition?

Serious Health Condition is defined as a serious, extreme, catastrophic, or life-threatening medical condition with a period of incapacity requiring the employee to be medically unable to work for a period of five (5) days or more. The medical condition includes continuing treatment or supervision by a health care provider; or continuing treatment of a chronic or long-term health condition. The employee must be suffering from an extraordinary or severe illness, injury, impairment, or physical or mental condition which has caused, or is likely to cause, the employee to take leave without pay.

- How does an employee request shared leave?

The employee must complete a shared leave application, provide medical documentation for the serious illness and send the application with documentation to the Shared Leave Committee for review.

- How much shared leave may an employee receive?

The Shared Leave Committee will determine the amount of donated leave an employee may receive and may only authorize an employee to use up to a maximum of four hundred and eighty (480) hours in a twelve (12) month period. An employee can not exceed two hundred sixty (260) days or two thousand eighty (2,080) hours of donated leave during total university employment.

- How can an employee donate leave to another employee?

The donating employee must complete a Shared Leave Donation Form and submit the form to the Shared Leave Committee.

- How much leave can an employee donate as shared leave?

The donating employee may donate any amount of paid leave provided the donation does not cause the paid leave balance of the employee to fall below 50% of their maximum annual accrual amount (see table below). An employee may not donate leave from their extended sick leave account. Donations must be made in full-hour increments.

- Will the unused leave I donate be returned to me if the recipient does not use all their available shared leave?

No, any unused donated leave will be placed in the Shared Leave Pool for distribution to qualified applicants.

- What happens if I donate leave to a specific employee and the employee is not approved by the Shared Leave Committee to receive shared leave?

If you donated leave to an employee and they are not approved to receive shared leave, the hours donated will be maintained in the shared leave pool to be distributed to other qualified employees. One way to avoid this situation is to have the recipient notify you when they are approved to receive shared leave and donate your leave at that time.

- Must leave be donated to a specific employee?

No, the donating employee may donate leave to the Shared Leave Pool to be distributed to qualified applicants by the Shared Leave Committee.

| Employment Category | Years of Service | Maximum Annual Accrual | Donation Cannot Reduce Your Remaining Paid Leave Balance Below This Amount |

|---|---|---|---|

| Executive Officers, Administrative Officers, and 12-Month Faculty | Each year | 33 days (264 hours) | 132 hours |

| All Other Staff | 1st-5th year (0-60 months) | 27 days (216 hours) | 108 hours |

| 6th-10th year (61-120 months) | 30 days (240 hours) | 120 hours | |

| 11 or more years (121+ months) | 33 days (264 hours) | 132 hours |